Free Market Cap Calculator

Make smarter investment decisions with our professional-grade market capitalization calculator. No signup required. No credit card needed.

Make smarter investment decisions with our professional-grade market capitalization calculator. No signup required. No credit card needed.

Professional-grade analysis tool used by investors and financial analysts

Enter company metrics and investment parameters to calculate potential growth over time. All calculations are performed locally in your browser — your data remains private.

100% Free • No signup required • Instant results

Professional-grade financial analysis tools that would typically cost hundreds of dollars - available completely free

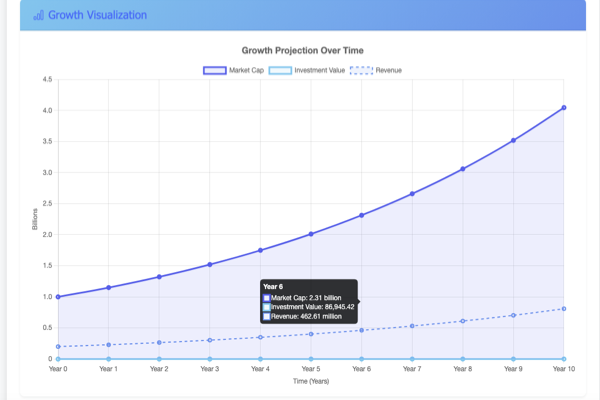

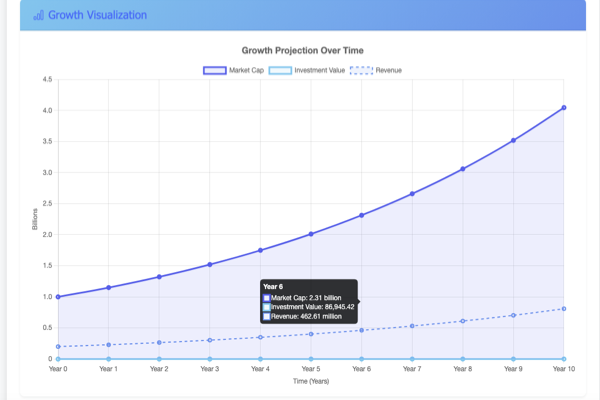

Advanced algorithms to visualize potential company growth based on historical data, market trends, and industry benchmarks.

Calculate how systematic investments can grow alongside market capitalization with custom monthly contributions and dividend reinvestment.

Incorporate multiple valuation metrics including P/E ratio, revenue multiples, and industry benchmarks for comprehensive analysis.

All calculations performed in your browser. Your financial data never leaves your device, ensuring complete privacy and security.

Create and download professional financial projections for your personal records or to share with your financial advisor.

Get immediate analysis with interactive visualizations and clear metrics to support your investment decisions.

No sign-up • No credit card • No limits

Understanding market capitalization is crucial for making informed investment decisions

Market capitalization is the total value of a company's outstanding shares, calculated by multiplying the current share price by the total number of shares. It's a key indicator of a company's size, stability, and growth potential in the market.

| Classification | Market Cap Range | Characteristics |

|---|---|---|

| Mega Cap | Over $200 billion | Highest stability, global presence, moderate growth |

| Large Cap | $10-200 billion | Established companies, reliable dividends |

| Mid Cap | $2-10 billion | Growth potential with moderate stability |

| Small Cap | $300 million-2 billion | Higher growth potential, higher volatility |

| Micro Cap | $50-300 million | Speculative investments, high risk/reward |

| Nano Cap | Under $50 million | Extremely speculative, highest volatility |

Market capitalization helps investors understand the risk profile of a company. Generally, larger market cap companies are more stable but may offer slower growth, while smaller market cap companies may provide higher growth potential with increased volatility.

Consistent revenue growth and strong profit margins typically support market cap expansion

Companies with strong market positions often command premium valuations

R&D investment and successful new products can drive market cap growth

Strong leadership and execution capability directly impact valuation

Broader economic trends can affect market cap across entire sectors

Everything you need to know about our free market cap calculator

Market cap projections are estimates based on historical data, industry trends, and current growth rates. While our calculator uses comprehensive algorithms to provide realistic projections, actual results may vary due to unforeseen market conditions, economic changes, or company-specific events.

We recommend using these projections as one of several tools in your investment decision-making process, alongside fundamental analysis, technical indicators, and professional financial advice when appropriate.

Revenue multiples (or Price-to-Sales ratios) reflect how much investors are willing to pay for each dollar of a company's revenue. Higher growth companies often command higher revenue multiples due to their future earning potential.

When a company grows its revenue while maintaining or increasing its revenue multiple, market capitalization can grow exponentially. Our calculator factors in these dynamics to provide more accurate projections of potential market cap growth across different growth phases and industry contexts.

Systematic Investment Plans (SIPs) allow investors to benefit from market cap growth through regular, disciplined investing. When investing in companies with strong market cap growth potential, SIPs can help average purchase costs and compound returns over time.

Our calculator integrates SIP investment models with market cap projections to provide a comprehensive view of how your investments might grow alongside company valuation increases. This approach accounts for both the time value of money and the power of dollar-cost averaging in various market conditions.

Industry Price-to-Earnings (P/E) ratios provide context for valuing companies within specific sectors. Companies in high-growth industries typically have higher P/E ratios than those in mature industries.

Our calculator uses industry P/E ratios to help estimate future earnings potential and corresponding market cap growth. This approach provides more sector-specific projections tailored to different types of companies and their growth trajectories, accounting for the unique valuation characteristics of various industry segments.

Yes, our market cap calculator is completely free to use with no limitations. There are no hidden fees, subscription requirements, or premium features locked behind paywalls.

We believe that professional-grade financial analysis tools should be accessible to all investors, regardless of their portfolio size or investment experience. Our mission is to democratize financial analysis by providing high-quality, free tools that help users make more informed investment decisions.

All calculations are performed entirely within your browser. The data you input into our calculator never leaves your device and is not stored on our servers.

We prioritize your privacy and security, which is why we designed our calculator to operate without requiring any data transmission. This ensures that your financial information and investment scenarios remain completely private.

Still have questions?

Contact Our Team